UOB One Account used to be a decent choice — especially if you paired it with the Lady’s Card for miles and a bit of monthly interest.

But these days? You’ll need to maintain SGD150,000 to get full interest. Not spend. Not accumulate. Just sit there and look pretty.

So I went shopping for alternatives — and landed on Revolut.

This isn’t a sponsored post. Just a heads-up from someone who took the scenic route through a few financial oopsies.

⚠️ Before You Get Too Excited…

✔️ Revolut isn’t MAS-regulated, which means:

✔️ Your funds may be at higher risk (Reddit is full of frozen-account horror stories)

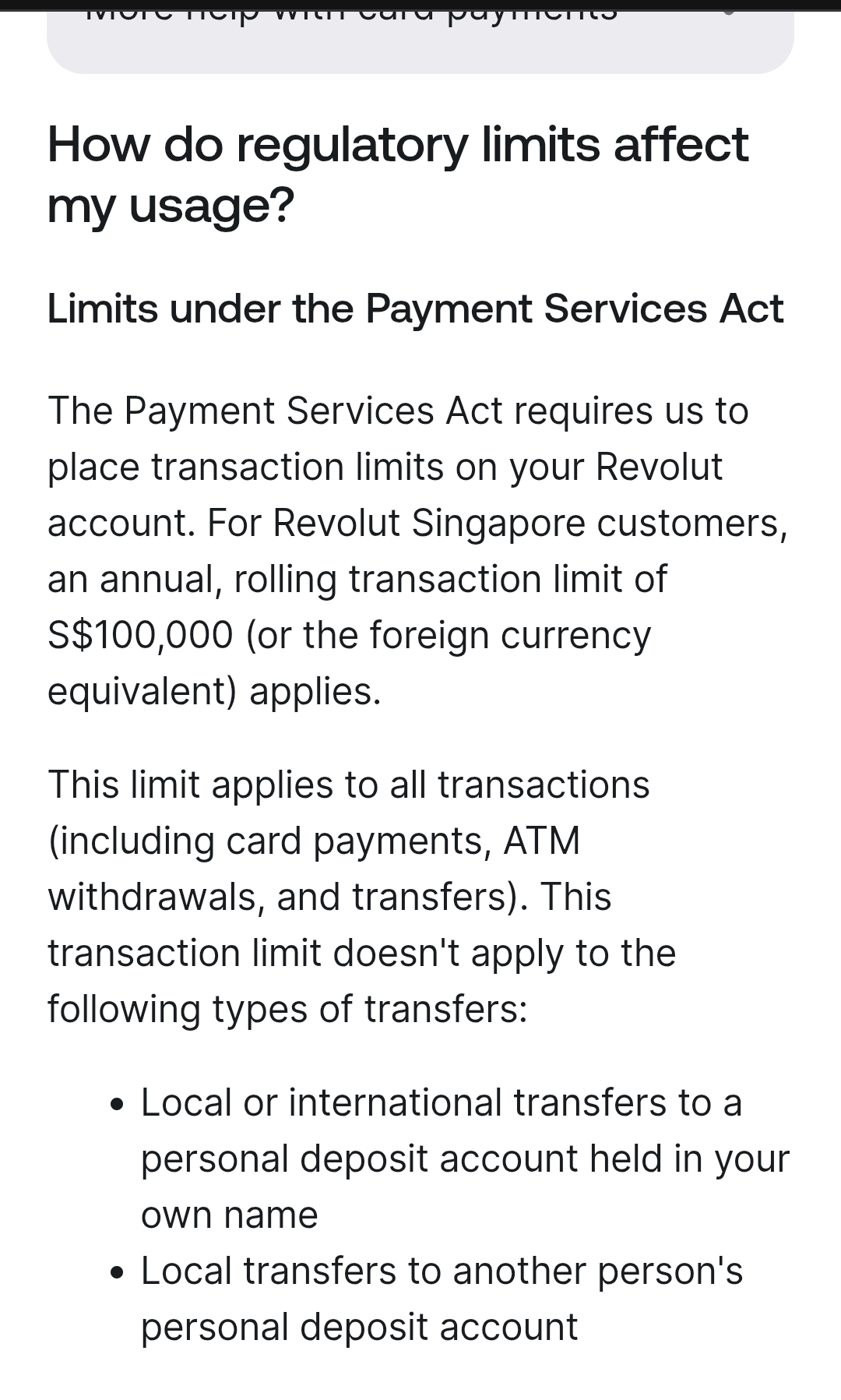

✔️ There’s a 365-day rolling SGD100,000 limit — and that includes retail spend, not just top-ups

→ I hit this cap unintentionally through regular shopping

✔️ Once you hit the cap, you can’t add funds to savings until the year resets

I’ve now got SGD8,000 floating in USD — converting it back would cost ~SGD50

→ Letting it sit there like a ghost of FX past

✨ Why I Still Use Revolut Metal

✔️ Higher interest (usually ~4.4%, updated daily, paid out daily)

✔️ No balance lock-in, no pre-requisite juggling

✔️ SGD219/year Metal plan unlocks extra perks

I almost cancelled Metal — until August 2024, when Revolut added some cheeky app perks:

✔️ NordVPN (which I already used)

✔️ 10 ClassPass credits/month

✔️ Tinder Gold — because hey, experience local culture too 😉 (who can say no to that?)

Not every city has ClassPass (Da Nang, Kaohsiung — nada), but Bangkok, Thailand delivered: I’ve redeemed both fitness classes and beauty sessions on-the-go.

💸 Monthly Interest Comparison (SGD20,000 Example)

UOB One Account

✔️ Salary credit > SGD1,600 + Card spend > SGD500

✔️ ~SGD437/year ≈ SGD36.41/month

Revolut Metal (USD savings)

✔️ ~SGD69.33/month, depending on daily rate

✔️ Note: No hard conversion fees, but FX spreads may “cost” ~SGD10–SGD50 depending on timing

You’re earning more — and skipping the monthly interest game show.

🌟 Final Thoughts

If you’re sitting on smaller savings and want flexibility (without pre-reqs), Revolut Metal is a worthy alternative. But it’s not risk-free — the SGD100K/year rolling cap includes spending too, which I only found out after maxing it out accidentally.

So yes, higher interest. But do your homework.

Especially if you’re eyeing that daily payout glow-up.

Just don’t ignore your FX rates like I did — or you’ll end up with money in limbo and a story for the blog.

📌 Want more real stories from the road?

Follow me on Instagram, TikTok, and YouTube for bite-sized tips, deeper travel dives, and honest insights from life abroad. 🚀

📌 Affiliate Disclosure:

This post may contain affiliate links, which means I may earn a small commission — at no extra cost to you — if you make a booking through them. This supports my blog so I can keep sharing cost-of-living breakdowns from around the world. I only recommend services I’ve personally used and loved!

Bonus Tip: If you’re planning your trip and haven’t locked in your activities yet, here are my go-to platforms:

💸 Not quite the vibe you’re looking for? Totally fair — we all spend differently, and I’m all for doing what makes life feel rich in your own way.

So have a scroll through the other places I’ve lived — whether you’re on sabbatical, reclaiming your time, or just out here to veg out in peace, we’ll find the one that feels like home (or at least a good month).

Leave a Reply